With an increase in the prevalence of chronic diseases and growth in surgical procedures, the incidence of associated surgical wounds and infections has increased. This will increase the demand for advanced wound care products and debridement procedures, along with advanced techniques like NPWT.

Surgical procedures are normally accompanied by wound infections, excessive bleeding, or tissue damage. Advanced wound care products such as honey wound dressings are loaded with antimicrobial agents and have emerged as viable options to reduce wound bacterial colonization and infection to improve the healing process.

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=88705076

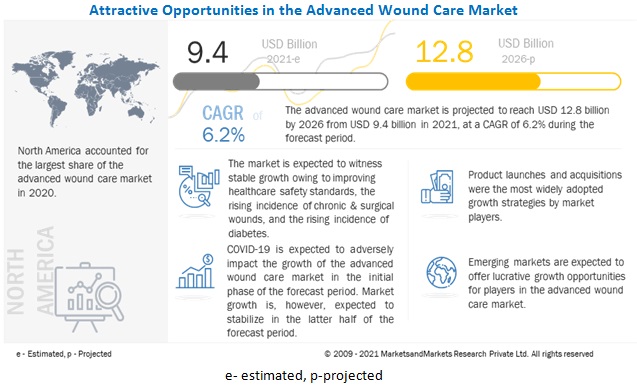

[289 Pages Report] The global advanced wound care market is projected to reach USD 12.8 billion by 2026 from USD 9.4 billion in 2021, at a CAGR of 6.2%. Market growth is driven by the increasing prevalence of diabetes, the high incidence of obesity, and the increasing number of surgical procedures across the globe. In line with this, the major trend in this market is the acquisition of small players by prominent players.

The manufacturing of advanced wound care products was significantly affected as major economies were severely affected due to the spread of COVID-19 infections. Players operating in the market are altering their long-term and short-term growth strategies by tapping the research market and developing innovative products to combat the pandemic.

Emerging economies such as India, South Korea, Malaysia, Vietnam, Africa, and Middle Eastern countries such as Israel, Saudi Arabia, and the UAE offer significant growth opportunities to major market players. This can be attributed to their low regulatory barriers, improvements in healthcare infrastructure, growing patient population, and rising healthcare expenditure. In addition, the regulatory policies in the Asia Pacific are more adaptive and business-friendly than those in developed countries.

The advanced wound care market is segmented into hospitals, ASCs, and wound care centers; home care settings; and other end users. In 2020, the hospitals, ASCs, and wound care centers segment accounted for the largest share of the market. Increasing hospital admissions for chronic wounds (such as pressure ulcers, diabetic foot ulcers, and venous leg ulcers) and the rising incidence of hospital-acquired pressure ulcers and infections are the key market drivers for the growth of this end-user segment.