Currently, no effective treatment for COVID-19 is available in the form of vaccines or antiviral drugs, and patients are currently treated symptomatically. According to the WHO, there are 70 vaccine candidates under development, and three candidates are already being tested in human trials. At the forefront of the COVID-19 outbreak, many researchers worldwide are engaged in the viral research of SARS-CoV-2, the virus that causes COVID-19. Live cell imaging systems, including advanced microscopy systems, help researchers investigate cellular behavior during viral research. Biomedical research requires the analysis of enormous amounts of data to develop vaccines. Therefore, major live cell imaging system providers, such as Leica Microsystems (Germany) and CytoSMART Technologies (Netherlands), have donated live cell imaging systems to assist COVID-19 researchers.

The normalization of the global economy will slowly increase the demand for live cell imaging systems in non-COVID-related research activity labs, leading to market growth from the first quarter of 2021. Furthermore, players operating in the market are altering their strategies, for both long-term and short-term growth, by tapping the research market and developing innovative products to combat the pandemic. On the other hand, even though the impact of COVID-19 on the live cell imaging market is low compared to other medical device markets, timely development and implementation of contingency plans are critical for business operations and, in particular, for key imported raw materials.

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=163914483

The traditional method of toxicity and drug safety studies involves the screening of large libraries through high-throughput screening. This method is expensive, has a low success rate, and is resource- and time-consuming. To overcome these challenges, pharmaceutical companies are increasingly adopting high-content screening (HCS) cell-based assays for identifying the effects of toxicity in drug development studies (cell-based imaging enables the monitoring of drug toxicity mechanisms, such as oxidative stress, micronuclei, mitochondrial dysfunction, steatosis, and apoptosis).

The use of HCS makes the drug development process more time- and cost-efficient. Owing to these factors, the adoption of high-content screening for toxicity studies is expected to increase during the forecast period. This, in turn, is expected to drive market growth as live cell imaging is used in HCS to identify meaningful information from complex systems such as in vitro, in vivo, and ex vivo systems.

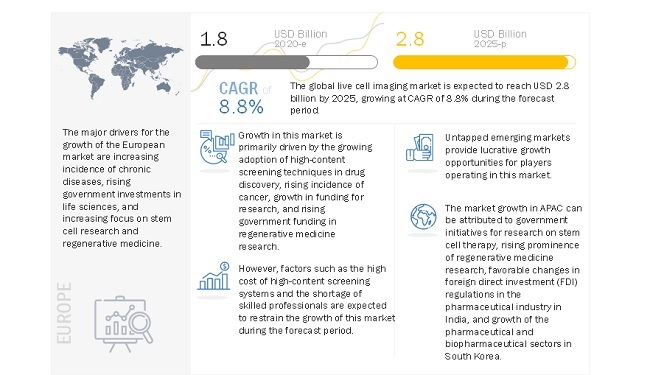

Growing adoption of high-content screening techniques in drug discovery and rising incidence of cancer primarily drives the market for live cell imaging. The growth in research funding and rising government funding and investment in regenerative medicine research will also support the market growth in the coming years. However, the high cost of high-content screening systems is limiting the overall adoption of these products.

Get Sample Pages For More Info @ https://www.marketsandmarkets.com/requestsampleNew.asp?id=163914483

Currently, China accounts for about 20% of the global RD spending and is the second-largest investor in RD, globally, after the US. The country is projected to overtake the US in RD spending by 2023 (Source: Council on Foreign Relations). Cost savings and a lack of regulations are among the most important drivers boosting preclinical activities in China.

The growing funding and investments in life science research, availability of highly skilled personnel, and a favorable regulatory environment are the other major factors supporting this trend. Moreover, currently, China has many CROs that provide preclinical and clinical research services to multinational pharmaceutical companies. The growth of preclinical/clinical research in China is expected to augment the demand for live cell imaging in the country in the coming years.

Running live cell imaging experiments successfully can be a major challenge. The conditions under which cells are maintained under microscopes decide the success or failure of the experiment. Therefore, maintaining living cells on slides is the most crucial part of the experiment. The cells used in experiments should be in good condition and function normally under a microscope in the presence of synthetic fluorophores or fluorescent proteins.

Additionally, maintaining a constant cellular environment is very important during the experiment; the cells should be grown in culture media in a carbon dioxide incubator. Temperature also plays a crucial role in maintaining cell viability in a culture. Hence, as the cell viability and cellular environment are dependent on several specific requirements, the chances of a live cell imaging experiment being unsuccessful are high.

The high growth rate of this region can mainly be attributed to the factors such as the government initiatives for research on stem cell therapy, the rising prominence of regenerative medicine research, growth of preclinical/clinical research in China, favorable changes in foreign direct investment (FDI) regulations in the pharmaceutical industry in India, and growth of the pharmaceutical and biopharmaceutical sectors in South Korea.

Key Market Players In Live Cell Imaging Market

The leading players in this market include Danaher Corporation (US), Carl Zeiss AG (Germany), Nikon Corporation (Japan), Olympus Corporation (Japan), PerkinElmer, Inc. (US), GE Healthcare (US), Bruker Corporation (US), Thermo Fisher Scientific Inc. (US), Sartorius AG (Germany), Oxford Instruments (UK), BioTek Instruments (US), Etaluma, Inc. (US), CytoSMART Technologies (Netherlands), NanoEnTek Inc. (Korea), Phase Focus Limited (UK), Tomocube, Inc. (South Korea), Phase Holographic Imaging PHI AB (Sweden), BD Biosciences (US), Sony Biotechnology, Inc. (US), Merck KGaA (Germany), KEYENCE Corporation (Japan), ibidi GmbH (Germany), Bio-Rad Laboratories (US), Logos Biosystems (South Korea), and Nanolive SA (Switzerland).